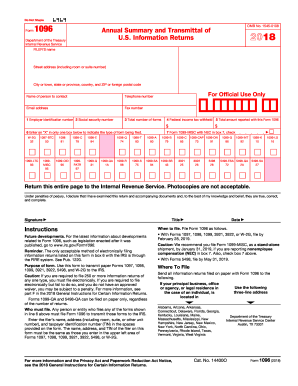

Who Needs Form 941c?

Form 941 is created for taxpayers who have previously filed Forms 941, 941-M, 941-SS, 943, 944, 944-SS, 945 or 843. The form isn’t filed separately. It needs to be filed together with any of the forms listed above.

What is Form 941c for?

Form 941c is called Supporting Statement to Correct Information and serves to provide supporting information to particular sections of earlier filed forms. These sections are: adjustments to income, social security and medicare taxes. Form 941c isn’t used for current adjustments. It is not required for group-term life insurance or sick pay adjustments for third parties. An important fact is that Form 941c isn’t considered to be an amendment return. Therefore, it can’t be filed separately. This is a kind of attachment to the form it supports.

Is Form 941c Accompanied by Other Forms?

The Supporting Statement to Correct Information is always attached to the form its supports. You can make as many adjustments as needed. Suppose you have submitted several returns that need correction. If that is the case, use 941c form for each form.

When is Form 941c Due?

According to the rules, a taxpayer is allowed to make adjustments within three years after a tax return’s due date or the day it was filed.

How do I Fill out Form 941c?

In total the form consists of five parts but not all of them need to be filled out. It depends on a taxpayer’s tax situation. However, at the very least, one needs to provide their name, telephone number and Employer Identification number. Part 1 should be completed with adjustments for overpayments only. If the adjustments are underpayments, there is no need to fill out part 1.

Part 2 accounts the federal income tax withholding. Part 3 is designed for Social Security tax adjustment. In part 4 provide Medicare tax adjustments. Part 5 contains fillable fields for additional explanations for the adjustments.

Where do I Send Form 941c?

Once ready, Form 941c is sent to the IRS either by mail or electronically.